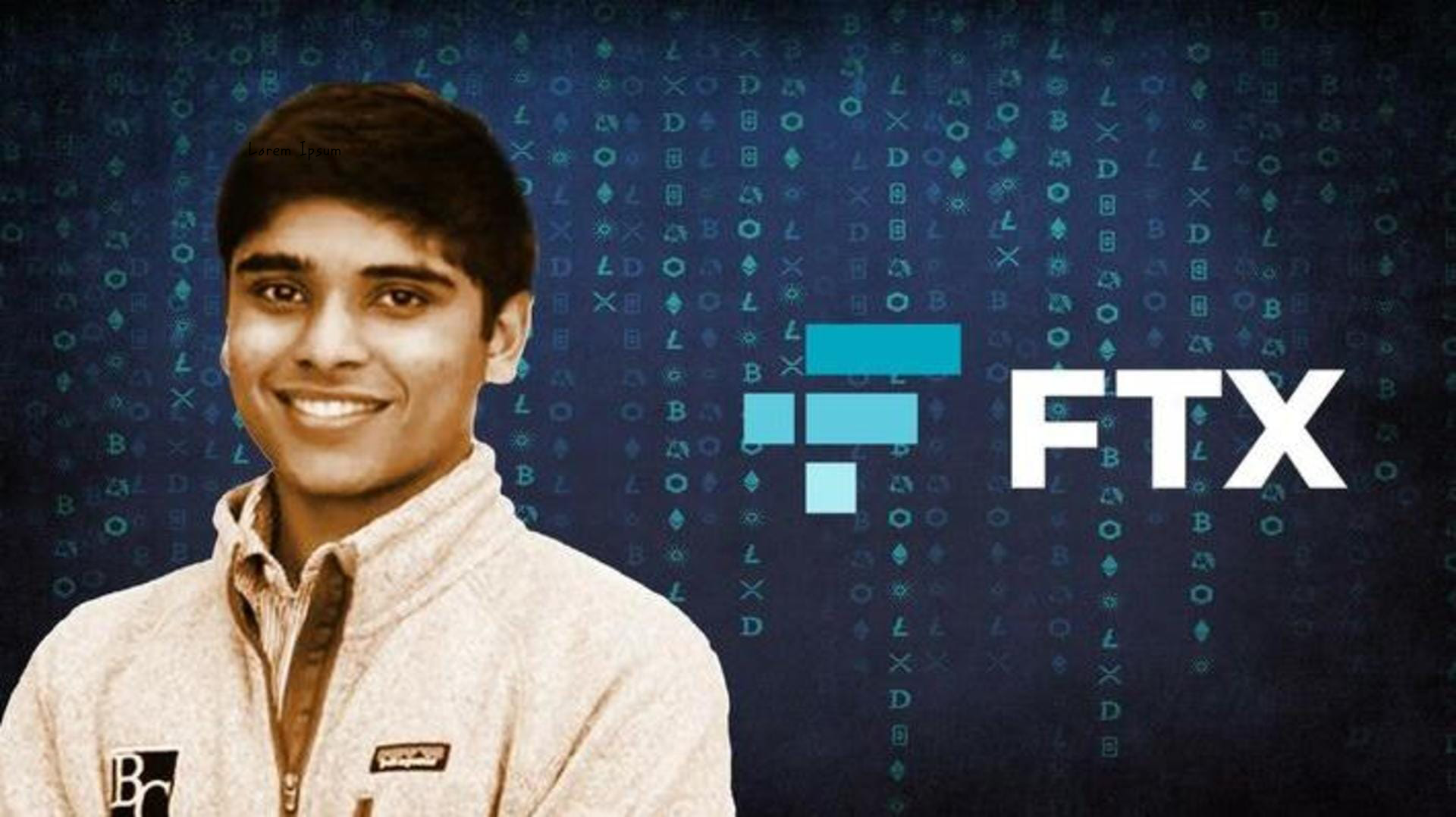

Nishad Singh

Nishad Singh has been scrubbed from wikipedia.

Singh was reportedly one of few people who knew that FTX was misusing customer funds, along with Bankman-Fried, Ellison, and Wang.

Singh's nearly 8% stake, which also included FTX subsidiary FTX.US, was worth about $572 million in March of this year. He previously received a $543 million loan from Alameda as well, according to bankruptcy filings.

"Gary is scared, Nishad is ashamed and guilty," Bankman-Fried told a Vox reporter after the firm filed for bankruptcy. "It hit [Nishad] hard."

Singh was a high school friend of Bankman-Fried's brother, Gabe. The former executive worked for a time as an engineer at Facebook (now Meta) before Bankman-Fried recruited him for Alameda, according to Singh's LinkedIn page, which has been taken down.

"In addition to building out much of our technological infrastructure and managing most of our dev team, his treatment of employees has earned him sole membership in our Slack group 'Kings of Kindness,'" Bankman-Fried previously wrote in a blog post.

Singh was likely one of the five coworkers that Bankman-Fried referenced as a billionaire, Bloomberg reported, citing an interview with the disgraced founder from earlier this year. In 2012, Singh also set the world record for fastest 100-mile run by a 16 year old, according to local newspaper The Mercury News.

A year after Singh became FTX's director of engineering, he became a steady donor for the Democratic Party. He gave $8 million to federal campaigns of Democratic candidates in the 2022 election cycle, according to nonprofit OpenSecrets.

"Currently, I'm sort of lucky that I can get fulfilled in many ways at this job - one of which is doing something that's probably pretty good from an effective altruist perspective," Singh previously said on a podcast.

Singh could not be reached for comment.

Bankman-Fried was released in December on $250 million bail and was sent to live in his parents' California home as he awaits trial.

On 12 November, anonymous sources cited by the Wall Street Journal said Alameda CEO Caroline Ellison disclosed to other Alameda employees that she, Sam Bankman-Fried, Gary Wang, and Nishad Singh knew that client deposits were transferred from FTX to Alameda. An anonymous source cited by the New York Times on 14 November said the same.Anonymous sources cited by the Wall Street Journal said the funds were used in part to pay back loans Alameda had taken to make investments. On 10 November, the Securities Commission of the Bahamas froze the assets of one of FTX's subsidiaries, FTX Digital Markets Ltd, "and related parties", and provisionally appointed an attorney as liquidator.Japan's Financial Services Agency ordered FTX Japan to suspend some operations. The company's Australian subsidiary was placed under administration.

On the same day, a team running the FTX Future Fund, a charitable group bankrolled by Bankman-Fried, announced their collective resignations.Future Fund had committed $160 million in charitable grants and investments by 1 September of that year.

- US authorities are turning their attention to FTX’s Nishad Singh: Report

- FTX’s Former Engineering Chief Nishad Singh Looking for Deal From Feds: Report

- Former FTX Executive Nishad Singh Planning to Plead Guilty to Fraud: Bloomberg

- Former FTX Engineering Director Nishad Singh Pleads Guilty to Criminal Charges: Reuters

- Nishad Singh testifies on Sam Bankman-Fried’s ‘excessive’ investments through Alameda

- Nishad Singh says there is ’a lot’ he doesn’t remember about FTX in 2022 — SBF trial

0 Response from Community